This is the time of year when dozens of articles are published purporting to have the secret to receiving that big tax refund. Some of the articles make it sound like tax professionals are hiding the answer from you.

This is the time of year when dozens of articles are published purporting to have the secret to receiving that big tax refund. Some of the articles make it sound like tax professionals are hiding the answer from you.

I’m sorry to say there is no “easy” button when it comes to that big tax refund, but want to know the real secret? Organized and accurate financial records. How could your tax professional help you take advantage of the myriad deductions out there when you can’t tell them what you spent your money on last year?

So go grab those piles/boxes/envelopes of receipts from last year and let’s get to work. There are lots of ways to get your information organized, but you want to get your taxes done now, right?

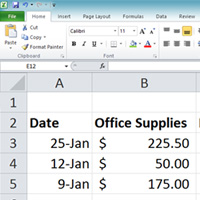

Open your spreadsheet program (Excel, Numbers, GoogleDocs, etc). In the second column, start labeling your categories – office supplies, meals/entertainment, insurance, licenses/fees, inventory, bank/merchant fees, professional fees, domain registration, start-up costs, etc. Keep the categories generic, but make a special list of large purchases like computers, electronics, equipment, etc. in the amount of $500 or more. We accountants call those fixed assets and they get special treatment on your taxes. Now start entering all those receipts with the date in the first column and the amount in the appropriate category column. Be sure to include items purchased with your credit card. The most commonly missed deductions by businesses are expenses paid from personal bank accounts, PayPal, cash, etc.

Once you think you’ve got it all in the spreadsheet, add totals for each column. Format the document to print or put it on a USB drive to take to your tax professional. Those are your total expenses. Now where are all of those invoices that make up the revenue you earned last year? Make a spreadsheet for those if that information is not already available in your e-commerce or invoicing software. While you’re at it, gather up those 1099s and any other tax documents you received in the mail. Your tax professional needs to see those too and may also require additional information depending on your situation, but this should get you off to a good start. Make a list of questions you want to ask your tax professional then make that appointment. Now. No procrastinating. This is the real secret to that big tax refund.

Next time we’ll talk about setting up an efficient system to gather this information throughout the year.