Tax day approaches. For individuals and businesses who follow the calendar year, your tax return is due by April 15, 2015. It is true you can request an extension to delay filing your taxes. Here’s why you should file your tax return by April 15:

File Your Taxes Now and Know What Changes to Make This Year

The sooner you file your tax return, the sooner you will know whether you owe taxes or will receive a refund. Filing your tax return sooner than later gives you the opportunity to start planning for the 2015 tax year by learning from what you did right or wrong for 2014. Did you pay the correct amount of estimated tax payments? What about contributing to a retirement account? Did you keep receipts for all the expenses you should have? When you request an extension, most of the next year is gone, and you lose the opportunity for tax planning and correcting things you did wrong last year.

Get Prepared, Then Meet with a Tax Professional

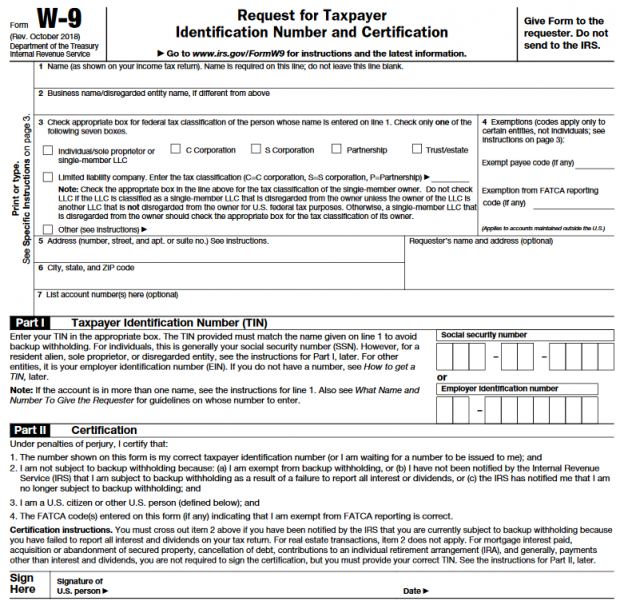

I recommend you have a tax professional prepare your personal and business tax returns. Partnering with the right tax professional will ensure you take advantage of tax deductions and credits to your advantage. To help you answer some of your questions and build a list to ask your tax professional, I recommend two resources:

J.K. Lasser’s Small Business Taxes 2015 by Barbara Weltman – This book discusses everything from choosing your business entity, handling income and losses, expenses, home office deduction, tax planning tips, and much more. Use this book as a reference year round to answer your quick tax questions.

Small Business Taxes Made Easy by Eva Rosenberg – You should read this book cover to cover. The author starts with the basics of starting a business, choosing an entity, business plans, income and deductions, pitfalls to avoid, and much more. She is an IRS Enrolled Agent and shares her years of tax experience throughout the book, including downloadable book updates, checklists, and resource lists.

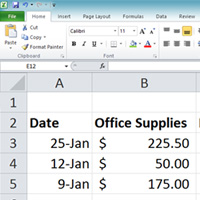

To make the most of your meeting with your tax professional, you need to have up to date accounting records, namely a balance sheet and income statements. Financial statements help you make timely business decisions. They also help your tax professional quickly get an overview of your company in order to provide the right tax advice for your situation.

So stop procrastinating and start gathering what you need to get those tax returns done. If your accounting records are in a bit of a mess, I can fix your accounting. Just get in touch.