Taking time to read the balance sheet report will help you identify bookkeeping mistakes and have a clearer view of your business.

If you prefer to watch a video of this post, you can find it here.

Locate the balance sheet report by clicking on the reports menu, then balance sheet report.

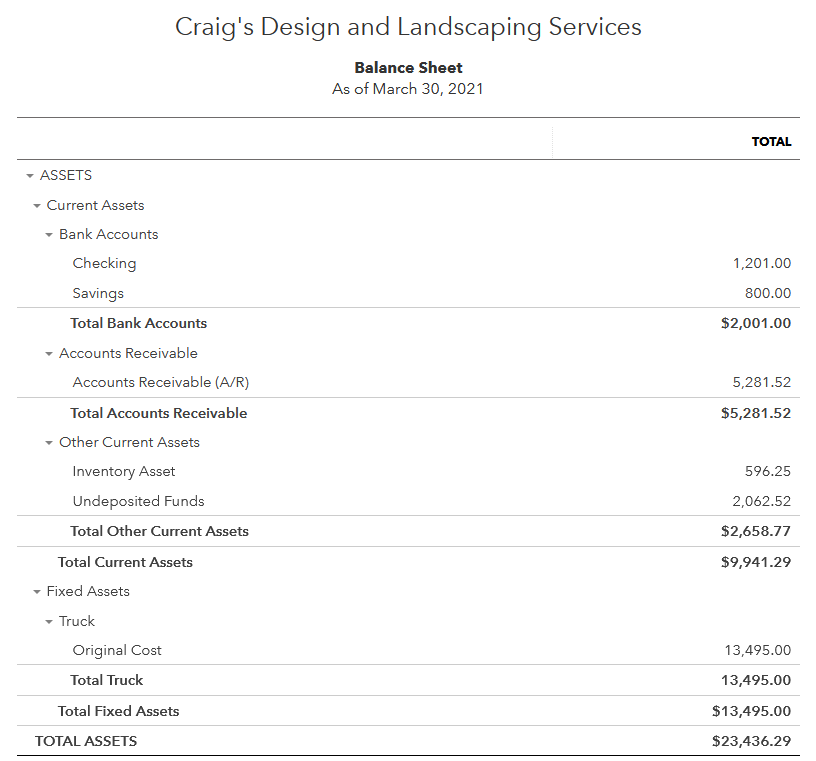

Bank Accounts

First and foremost is the bank accounts. The bank account balances on the balance sheet report should be very close to the actual bank balance. Look at the reconciliation report for the section listing uncleared items, particularly older items. Uncleared items in any bank account are problems requiring action to fix. Checks you have written may not have not been cashed, duplicate transactions have been created, or other mistakes exist.

Accounts Receivable

Next, the accounts receivable account balance is the amount customers owe. If this number is too high or too low, it could be why your bank balance and sales figures are incorrect. Creating a new transaction rather than matching deposit items in the bank feed will create duplicate transactions.

Inventory

Inventory purchases could be recorded incorrectly if the amount on the balance sheet is incorrect. Another possibility is that invoices are created incorrectly so that items are left in inventory rather than moved to the cost of goods sold expense account. Inventory is difficult to manage. Invest time to set up your items correctly and understand the correct workflow to avoid problems.

Undeposited Funds

A common source of bookkeeping errors in QuickBooks is the undeposited funds account. Undeposited funds is the account where invoice and sales receipt payments are automatically recorded. It’s a holding account. QuickBooks will automatically send payments to this account unless you choose your bank account.

When a payment is recorded on an invoice, be sure to create the deposit. If the undeposited funds number is very large, it could add to problems in the bank account. Perhaps a new sale or deposit is recorded in the bank feed rather than matching the deposit to an invoice payment. This will inflate your sales amount. The undeposited funds account should always be almost zero.

Fixed Assets

Finally, fixed assets is last but not least. IRS guidelines suggest items purchased for less than $2500 be recorded as an expense. Record items that cost over $2500 as a fixed asset. If you track fixed assets, your bookkeeper should record the depreciation from the tax return. This may not contribute to actual bookkeeping mistakes. However, fixed asset accounts should always have a positive balance. It’s a common oversight to not record depreciation to match what’s on your tax return. You want to know what your assets are worth right? It’s also useful to know how much depreciation expense you can use to lower your tax bill.

Need help to fix your balance sheet? Schedule your free discover call now!